Re-Opening

- Federal Guidelines

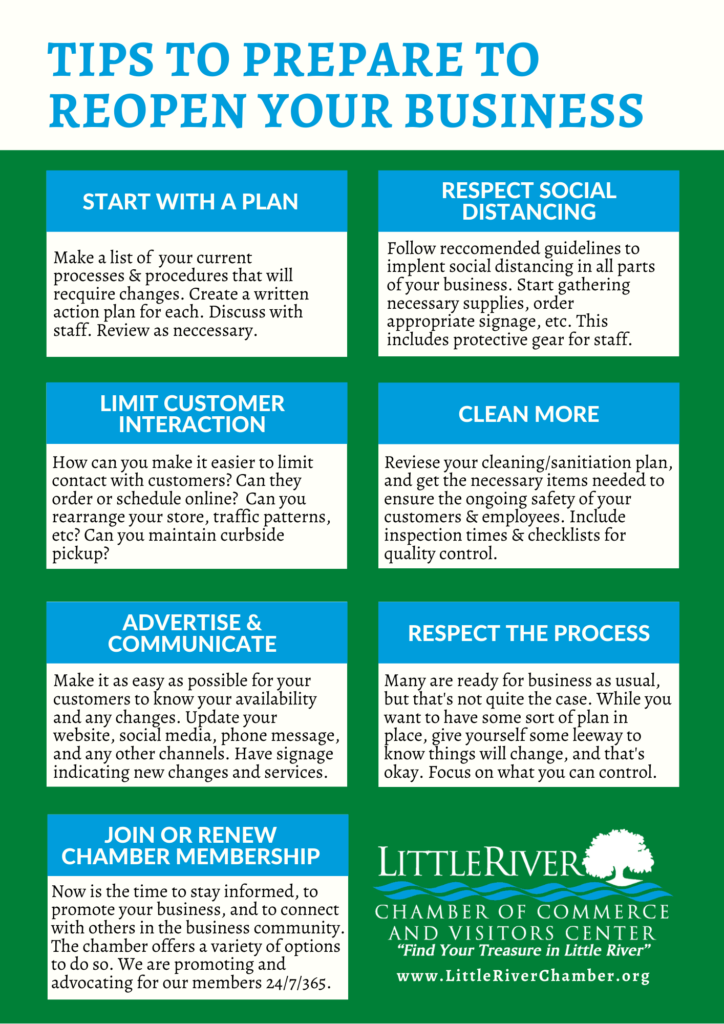

- Getting Back to Business – COVID-19 Guide

- general guidelines for close contact service providers

- Specific Re-Opening Guidelines:

- Relief and Recovery Agenda for SC Businesses

- Return to Work Employer Checklist

- SC Governor’s Reopening Plan

- Business Continuity – Planning Basics

- Operation Open Doors – Checklist

COVID-19 News for Area Businesses

- 5/18: SC to re-open additional close contact businesses

- 5/11: SC restaurants reopen indoor dining

- 5/4: Restaurants reopen outdoor dining

- Non-Essential Business Listing

- 4/30? – state-wide stay at home order expired

- 4/22: Gov. McMaster has announced that schools across S.C. will remain closed for the rest of the school year.

- 4/8: New Executive Order Allows Furloughed Employees to Qualify for Unemployment

- 4/3: S.C. LLR Extends Renewal Deadlines During Health Emergency

- 4/2: IRS Warns about Coronavirus related scams

- 4/1: U.S. Department Of Labor Announces New Paid Sick Leave And Expanded Family And Medical Leave Implementation

- 4/1: Horry County Offers Assistance for Businesses during State of Emergency

- 3/31: IRS: Employee Retention Credit available for many businesses financially impacted by COVID-19

- 3/27: SCDMV extends deadline for vehicle registrations, licenses

- 3/26: SCDOR extends deadlines of taxes administered or filed to be due between April 1 – June 1 to June 1. Income taxes originally due April 15 now due July 15.

- 3/21: To-Go Beer & Wine Sales Approved

- Hotels – Federal Hotel Leasing Program

- 3/19: SC Tax Relief from COVID-19 outbreak

- 3/19: H.R. 6201: Families First Coronavirus Response Act

- 3/17: SC Supreme Court halts all SC evictions through May 1

- 3/17: dine-in now prohibited at SC Restaurants

- 3/17: Horry County Treasurer’s office waives e-check fees for business license, hospitality fee transactions

- Employment

- Horry County Updates

- Questions about COVID-19 impacts in Horry County? Call the Horry County Emergency Management phone bank at 843-915-5000 (8 a.m.-5 p.m. M-F.)

- SBA

Key Sources:

- Horry County: News Releases

- Governor McMaster: Executive Orders | Newsroom

- SC Chamber COVID-19 Resources

We’ve been deleted resources as they become irrelevant. For a timeline events, click here.

Tips & Resources for Businesses during COVID-19

Assuming you have already taken the steps outlined by the South Carolina Department of Health & Environmental Control & the Centers for Disease Control and Prevention (CDC), here are some additional, timely resources & tips:

- Pandemic Guidance

- Webinars, business training, and networking events

- Interim Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19)

- Key planning recommendations for Mass Gatherings in the context of the current COVID-19 outbreak: Interim guidance

- Understanding the Coronavirus

- Workbook: Disaster Prep & Resiliency Toolkit for Businesses

- Getting Back to Business Guide

People

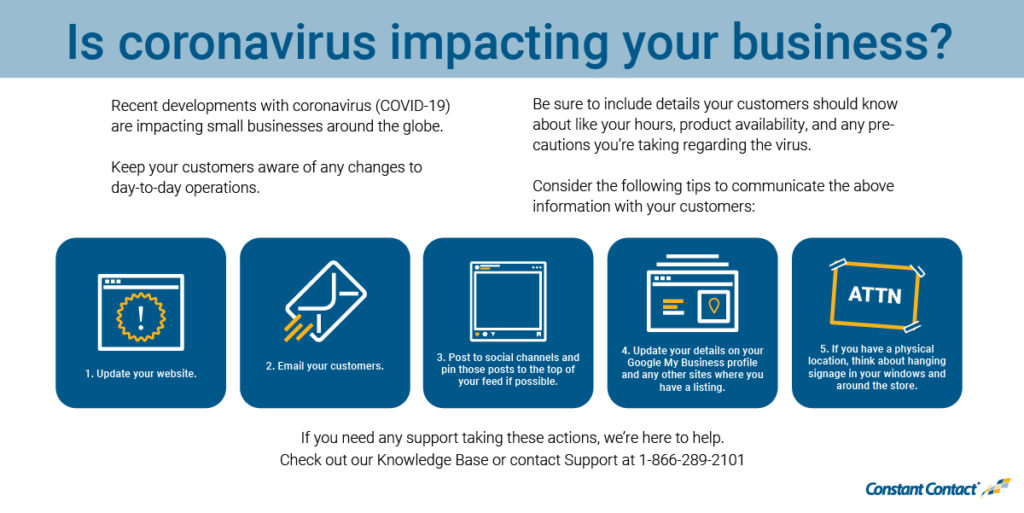

- Keep communicating with your customers, and stay active on social media. Let your customers know that you are open for business, or remind them how you can help. Let them know what you are doing to protect their health as well.

- Keep communicating with your team as well. They need your leadership and certainty.

- Mental Health And COVID-19 – Information And Resources

- If you are in retail or service or another public facing business, what can you do to protect both your customer base and your employees? Leverage technology and easy pick-up or delivery, for example.

- Actively encourage sick employees to stay home

- Separate sick employees

- Emphasize staying home when sick, respiratory etiquette and hand hygiene by all employees

- Mass Gatherings and Events Guidance

- Coronavirus and Workers’ Compensation

- More

Employment

- COVID-19 Unemployment Insurance FAQs

- Employer Claims

- Individual Claims

- Professional/Occupational Licensing Information

- SC DEW

- US Dept. of Labor:

- COVID-19 and the Workplace

- Employee Rights (FFCRA)

- 4/5 U.S. Department Of Labor Publishes Guidance on Pandemic Unemployment Assistance

- 4/4 U.S. Department Of Labor Publishes Guidance on Federal Pandemic Unemployment Compensation

- 4/3 U.S. Department Of Labor Announces Additional Guidance Following Paid Sick Leave and Expanded Family and Medical Leave Implementation

- 4/2 U.S. Department Of Labor Announces New CARES Act Guidance on Unemployment Insurance for States in Response to COVID-19 Crisis

Human Resources

- Finalize work strategies and protocols should you need folks to work from home, or make changes to staffing. Tools:

- GoogleDrive, Dropbox, – online storage/asset management

- Slack – daily tasks & chat

- Zoom – video meetings

- Calendly – appointment scheduling

- Clockify – time tracking

- More tools

- For meetings with large groups, consider moving online. You can still get the work done, and it may actually save you time. Zoom, GoToMeetings, Microsoft Teams are all great tools for this.

- Family First Coronavirus Act

- Department of Labor downloadable poster for the Families First Coronavirus Response Act Notice – All employers should post by April 1st.

- H.R. 6201 Family First Coronavirus Response Act

- DOL Announces New Guidance on Unemployment Insurance Flexibilities – DOL announced new guidance outlining flexibilities that states have in administering their unemployment insurance (UI) programs to assist Americans affected by the COVID-19 outbreak.

- Stay Productive When Working Remote – Archetype SC has put together a brief article on working remotely during COVID-19, with some special deals. Read more HERE

Health & Safety

- Latest SC DHEC Health Information

- Virtual Health Visits

- CDC Guidance for Businesses

- SC DHEC Guidance for Businesses

Operations

- Review your supply chain and analyze potential impact and alternatives for supplies.

- Review finances, work on contingencies of how to manage finances should business begin to slow, talk with your banker about options that you can tap into should the need arise.

- Set up authorities, triggers, and procedures for activating and terminating the company’s infectious disease outbreak response plan, altering business operations (e.g., possibly changing or closing operations in affected areas), and transferring business knowledge to key employees. Work closely with your local health officials to identify these triggers.

- Talk with your business insurance provider as well.

- If business does slow, document your losses. If the COVID-19 situation escalates, disaster declarations could be made that trigger the availability of federal economic injury assistance for small businesses.

- How will you handle travel?

- How restaurants can better assist customers during times of uncertainty

- OSHA:

- We realize that the uptick in cancellations may feel alarming. Remember that these are all strategies to stop the spread. It is possible for people with no symptoms to spread diseases.

- Frequent and deeper cleaning of the office and home. Most Clorox, Lysol and Purell products should fit the bill. A full list of product that can be used during the coronavirus (COVID-19) outbreak is here: https://www.americanchemistry.com/Novel-Coronavirus-Fighting-Products-List.pdf

- DHEC has developed an emergency procedure for conducting a virtual “food safety check” instead of regular inspections. If you would like us to conduct a food safety check, please contact your regional DHEC office

- As part of the recommendations for opening, DHEC and the SCRLA have been working together on the required signage and forms to make them available to the members. Click here to download and print.

- Data and Network security risks relating to coronavirus

- Coronavirus Hub: Adapt Your Business

Small Business Financial Assistance

- BA Loan Resources

- SBA Economic Injury Disaster Loan (EIDL)

- $10K Advance on EIDL

- Economic Injury Disaster Loan Fact Sheet

- Apply Online-Economic Injury Disaster Loan

- Paycheck Protection Loan

- Paycheck Protection Loan FAQs

- Upd. 5/13: PPP FAQs

- Emergency Loans-Small Business Guide & Checklist

- Small Business Owner’s Guide to CARES Act

- CARES Act Small Business FAQs

- More

Insurance, Regulatory & Tax Support

- Business Interruption Insurance Information

- Tax Extension Information

- Tax Relief FAQs

- Federal Payroll Tax Credits

- Compliance Assistance for Regulatory Relief

- Fuel Waiver (RVP)

- IRS People First Initiative (taxpayer assistance)

- Business Interruption & Extra Expense Claims Guide (COVID-19)

Additional Resources

- World Health Organization: who.int

- Centers for Disease Control and Prevention (CDC): cdc.gov

- SC Department of Public Health (SCDHEC): scdhec.gov or 1-855-472-3432

- Horry County Government & Emergency Management

- Area News – the Twitter List

Find these tips useful? Find more business tools and information by visiting the Business Resources page or After Disaster Management page.

Next: